Best auto and home insurance companies in Washington state

What is Health Insurance?

Health insurance is a contract between an individual and a health insurance company that agrees to pay for medical expenses incurred by the insured.

Health insurance companies are typically regulated by government agencies. They are not-for-profit organizations that collect premiums from employers and individuals, invest the money in order to provide medical services and pay claims to policyholders.

The health insurance industry is one of the largest in the United States. Healthcare spending is expected to rise from $2 trillion in 2013 to over $5 trillion by 2022.

Deductible: You pay a specific amount before your insurance provider starts paying for health care costs.

Coinsurance: You’ll pay a shared amount of money toward an insurance claim if you take out an insurance policy with this provider.

Copay: A fixed amount of money you are charged for each visit to the doctor or prescription.

The amount you pay for health insurance varies based on factors such as:

-

Age

-

Location

-

Income

-

Smoking habits

-

Body mass index (BMI)

-

Overall health status

-

Preexisting conditions

The Centers for Medicare and Medicaid Services (CMS), a federal body that oversees these programs, regulates your rates if you are 65 or older or under 65 and disabled according to the Social Security Administration and are qualified for Medicare. The cost of health insurance is different for different people but usually determined by factors such as your age, family size, and income.

Best Health Insurance Providers in Washington

The National Committee for Quality Assurance (NCQA), an independent, non-profit organization dedicated to improving health care, evaluates private insurance plans in the areas of prevention, treatment, and consumer satisfaction every year. Here are their top suggestions for health insurance plans in Washington, based on their findings:

These are the Best Health Insurance Companies in Washington State 2024;

- Kaiser Permanente

- Providence Health Plan

- Regence BlueShield of Washington

- Aetna

- BridgeSpan

- Coordinated Care

- LifeWise

- Molina

- Premera Blue Cross

1. Kaiser Permanente

Kaiser Permanente is known for its quick and easy access to care, comprehensive services, and preventative services, and is ranked among the top 5% of hospitals in the country in terms of quality.

Kaiser’s mission is to serve people in Washington with affordable, high-quality healthcare plans and services. The business offers a variety of health plans to cater to people’s various demands and requirements. It is one of the Best Health Insurance Companies in Washington.

2. Providence Health Plan

In the NCQA assessment, Providence Health Plan’s PPO plan achieved a 4.0 out of 5 rating, citing outstanding specialists, claim management, and care quality. In the 2019 Commercial Member Health Plan Satisfaction Study, J.D. Power gave Providence’s plans good scores for communication, provider choice, billing, customer service, coverage and benefits, and cost. Group plans, individual and family policies, and Medicare plans are all available via Providence. It is one of the Best Health Insurance Companies in Washington.

3. Regence BlueShield of Washington

In the NCQA survey, Regence BlueShield of Washington’s PPO plan had a 3.5 out of 5 customer satisfaction rating, placing it fourth overall. In J.D. Power’s analysis, Regence was placed fourth, with great provider choice, billing, customer service, coverage, and benefits. It has links on its website to help you identify dental providers, behavioral health institutions, and plan information. It is one of the Best Health Insurance Companies in Washington state 2024.

ALSO SEE: Best Online Motorcycle Insurance Quotes

4. Aetna

The PPO plan from Aetna, which came in fifth place in the NCQA survey, scored strong grades for treatment and prevention. In J.D. Power’s research, Aetna came in eighth position for overall satisfaction, provider choice, and customer service. Aetna, a health and wellness company, provides users with an app that combines your health history with specific goals so you can track your progress. If you meet your objectives, you can receive incentives such as gift cards from famous merchants.

5. BridgeSpan

BridgeSpan is a new insurance firm that operates as an associate of Cambia Health Solutions, its parent company. This business strives to make healthcare more convenient and accessible for all residents of the state. It is one of the Best Health Insurance Companies in Washington state.

BridgeSpan offers a wide range of health plans through Washington’s health insurance exchange marketplace, which you may access online. One thing to keep in mind is that Medicaid in Washington is known as ‘Apple Health.’ Year-round, you can apply for health insurance and low-cost or even free coverage through Health.

BridgeSpan’s plans cover a wide range of products and comply with all ACA (Affordable Care Act) standards.

6. Coordinated Care

This is a managed care organization in Washington State that serves up to 200,000 individuals with healthcare.

It aims to raise people’s healthcare standards in the state by providing them with inexpensive and accessible healthcare options.

Your eligibility for the health insurance plans offered by Coordinated Care is determined by your age, income, and family size. It is one of the Best Health Insurance Companies in Washington state 2024.

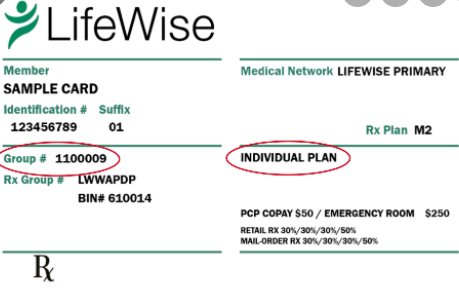

7. LifeWise

This insurance company has a long history in Washington, has an A credit rating, and can provide healthcare to more than 2.2 million individuals.

Except for Skamania, Franklin, Kitsap, Pacific, Grays Harbor, and Wahkiakum, LifeWise plans are available in all Washington counties.

This insurance company offers three levels of coverage: Bronze, Silver, and Gold.

All three offer nearly identical care and coverage, which includes office visits, virtual care, hospital treatments, and prescription medicines.

The most significant distinction between the three is that you either pay a reduced monthly premium or pay less at the time of service.

Get optional dental insurance when you join a LifeWise medical plan. It is one of the Best Health Insurance Companies in Washington state.

8. Molina

Healthcare providers are increasingly offering affordable, accessible, and quality care to people who receive government assistance. They work hard to provide these services and can also offer you insight into what’s still not covered by your current healthcare plan.

9. Premera Blue Cross

Premera Blue Cross covers more than 2 million people and is the largest health plan in the Pacific Northwest, with the purpose of controlling rising medical expenses and providing quality healthcare to residents of the state.

Premera Blue Cross has a variety of individual and family health insurance plans available through Washington Healthplanfinder. It is one of the Best Health Insurance Companies in Washington state.

Types of Health Care Plans

There are 2 major types of health care plans available:

Health Maintenance Organization (HMO) Plans

You must use a network of doctors, specialists, and hospitals if you have an HMO plan; if you choose a provider outside of the network, you will be charged full price. You’ll also need to choose a primary care physician to see on a regular basis. Your doctor must provide you a reference if you need to see a specialist. HMO plans promote maximum health by focusing on health and wellness.

HMO plans provide fitness and weight loss programs, smoking cessation programs, and blood pressure medicine to assist you to achieve your goals. HMO plans are less expensive than PPO plans, but they are more restrictive in terms of where you may get the care and which doctors you can see.

Preferred Provider Organization (PPO) Plans

PPO plans provide access to a vast network of hospitals, specialists, and doctors from which to pick. You are not required to select a primary care physician, but you are strongly urged to do so. Because those clinicians and hospitals have agreed to charge set amounts for care, you’ll spend less if you choose providers within your PPO network.

PPO plans do not require referrals, and you can change providers at any time. If you choose medications from their preferred drug list and utilize a pharmacy from their approved pharmacy provider list, you’ll save money on prescription drugs. PPO plans provide you more flexibility, but they’re usually more expensive.

Average Cost of Health Insurance in Washington

The average cost of health insurance in Washington is $4,937. This includes a single person’s premium and the deductible.

In Washington, the average cost of health insurance is $4,937 per year for a single person. This includes the monthly premium and deductible that one has to pay before their insurer pays for medical expenses.

The average monthly cost of healthcare in the United States per individual per month is $449, according to the Washington Office of the Insurance Commissioner.

What Does Health Insurance Cover?

Doctor appointments, inpatient and outpatient stays, specialist visits, skilled nursing care, physical therapy, and some medical supplies are all covered by most insurance policies. When you sign up for a health plan, you’ll receive a document called an Evidence of Coverage that explains what’s covered.

What Does Health Insurance Not Cover?

There are some things that health insurance does not cover. The majority of plans do not include:

-

Medical expenses incurred as a result of illegal activity

-

If you file a fake claim or use another person’s health card, you will receive care.

-

Unless your policy covers it, you will obtain medical care when traveling abroad.

-

The majority of nursing home care

-

Certain vaccines are required.

-

Expensive therapies or medications or treatments that are still being tested

If you have any queries concerning exclusions, contact your plan’s customer support number.

Washington’s Insurance Industry and How it’s Been Transformed by Obamacare

Washington’s insurance industry has been transformed by Obamacare. This is due to the fact that it is now mandatory for all people in Washington to have health insurance and it’s no longer possible to get a private plan.

Insureds & Uninsureds in Washington, How Health Coverage Affects Wealth Distribution in America

The uninsured rate has been rising in America over the last few decades. The US Census Bureau reports that in 2014, the uninsured rate was at 13.4%. This is a significant increase from the 8% of Americans who were uninsured in 1980.

With so many people without health coverage, it’s no wonder that healthcare costs are rising. In 2015, healthcare spending accounted for 17% of GDP, which is close to twice what it was in 1980.

The Affordable Care Act (ACA) has helped to reduce the number of uninsured Americans by expanding Medicaid and offering subsidies for private insurance plans through exchanges and state-based marketplaces called marketplaces.

What is the ACA (Affordable Care Act)?

The ACA is designed to provide health insurance coverage for all Americans. It also provides stability and security for people who have health insurance.

The ACA is a law that was created in 2010 and has been in effect ever since. The law is often referred to as Obamacare, but the official name of the act is the Affordable Care Act.

Washington State’s Affordable Care Act Problems

Washington State is one of the few states that opted to create their own healthcare exchange, called the Washington Health Benefit Exchange. However, problems with the exchange are threatening to throw the whole system into chaos.

The Washington Health Benefit Exchange has been plagued by technical difficulties since it went live in October.

The exchange website was down for nearly two weeks and was unavailable for hours each day, leading to many frustrated customers who were unable to sign up for insurance or find out whether they had coverage.

Washington State’s Affordable Care Act Problems are a result of a lack of planning and preparation that led to a rushed implementation in October.

Health Insurance Companies are Causing Washington State to Fail on Getting Healthcare For All

Washington state is failing to meet the goal of providing healthcare for all. The state’s health insurance companies are causing this failure by not providing affordable plans and increasing premiums.

The Affordable Care Act (ACA) has provided a lot of help in the fight against healthcare inequality. This law has helped reduce the number of uninsured people by 21%. But Washington state is not doing as well as other states with respect to ACA implementation, and it’s due to their health insurance companies that are raising premiums and lowering benefits.

Washington state is failing on getting healthcare for all because they are not meeting their goal of providing affordable plans and increasing premiums. The ACA has helped reduce the number of uninsured people, but Washington state is falling behind on implementing ACA because they have high rates of uninsured people and low rates of coverage from their Medicaid program.

The Possible Solutions to Washington State’s Affordable Care Act Issues

Washington state’s Affordable Care Act has been a challenge for the state. The state is now looking to Congress for more support in order to fix their problems.

The possible solutions to Washington State’s Affordable Care Act issues are:

1) Congress will approve a federal waiver that will allow Washington State to create their own exchange rather than using Healthcare.gov,

2) Washington State will be able to implement a reinsurance program,

3) Washington State will be able to increase the individual mandate penalty and/or work requirements, and

4) Washington State’s Medicaid expansion would be expanded under the ACA.

How Washington Could Fix Its Healthcare Problem

Washington is facing a healthcare crisis. This is because the state has a high cost of living, a large population, and a shortage of doctors.

Washington could fix its healthcare problem by creating more incentives for medical professionals in the state and by increasing funding for its public health programs.